Blogs

- Latest Rulemaking to your Simplification of Deposit Insurance rates Regulations to have Believe and you may Mortgage Repair Profile

- Discover Your Coverage Constraints

- Insurance for the S’pore-dollar financial dumps to increase of $75,000 in order to $one hundred,100 from April 2024

- Next Online game Release Agenda

(1) Instructional professionals considering under the GI Statement are derived from the brand new veteran’s very own military service. Informative benefits (i.elizabeth., pros for college students) under the FECA derive from the utilization as well as the related handicap or loss of the brand new recipient’s relative. The fresh ban up against concurrent repayments present in 5 U.S.C. 8116 is applicable just to repayments based on the exact same impairment or passing. No election is required to have instructional pros within the GI bill. (3) The newest ban does not extend in order to pensions, as the Section 5 U.S.C. 8116(a)(2) explicitly will bring that there surely is no restriction to the right to help you discovered FECA payment by acknowledgment away from a pension for services from the Military, Navy or Heavens Force.

- The period of your own honor often boasts a portion of an excellent time conveyed since the a decimal, and this refers to repaid after the newest prize period.

- If your evidence of document are not enough to support the period stated, the brand new Le must provide the newest claimant (and registered associate, if any) with notice and a way to act and you may give the mandatory evidence.

- When the finance is actually offset to settle the new OPM to own a period of time of dual professionals (come across FECA PM ), the newest OPM becomes an incident payee, even if a fees isn’t keyed to the new OPM.

- These types of workers are within the Professional and Administrative Salary (EAS) spend structure, which also discusses executives, benefits, administrators, postmasters, and you may technical, management and clerical staff.

Latest Rulemaking to your Simplification of Deposit Insurance rates Regulations to have Believe and you may Mortgage Repair Profile

The fresh publicity restriction to have Singapore-money places try history elevated within the April 2019, away from $fifty,one hundred thousand so you can $75,one hundred thousand, securing 91 percent away from depositors at the time. On the other, too much need for mutual functions will get force reciprocal deposit profile apart from financial’s caps, meaning that cause higher expands inside the brokered deposits also. This should force a lender on the embarrassing situation out of choosing anywhere between fascinating the people otherwise their bodies—for each driving on the reverse direction. The newest disappointments from Silicon Area Bank, Silvergate Financial and Signature Financial in the February 2023 and the resulting financial disorder have raised the new appetite to possess deposit insurance policies. Also, Impression Deposits Corp. also provides insurance protection to possess too much deposits with their network of almost 2 hundred FDIC-covered area banks.

Discover Your Coverage Constraints

The fresh $fifty,one hundred thousand work with repaid to help you survivors from Government Police officers just who pass away while the the result of a personal injury sustained on the distinct duty beneath the Department from Fairness doesn’t make-up a dual work for. (4) Medical benefits is actually payable concurrently having severance and you will separation shell out. (2) In the an accepted demise circumstances, the new Ce have to determine whether the newest decedent try an experienced. (b) Below specific issues, veterans’ advantages to own a widow(er) plus the eligible youngsters are divisible. Mentioned one other way, the child otherwise college students have an excellent “separate and you will independent correct out of election” so you can veterans’ pros. (b) The amount of the newest payment should not be expert-ranked in order to take into account utilization of the combination means.

(f) The fresh Le should not attempt to assign a new portion of disability than assigned because of the DMA without the advantageous asset of subsequent medical clarification. (a) If your DMA isn’t able to incorporate rationale to the portion of disability specified, the newest Ce will be request a clarification or an extra statement from the new DMA. If the claimant’s medical practitioner will bring an impairment declaration, otherwise following next view is actually received, the truth will likely be described the fresh DMA to have opinion. A routine prize for the surface might be paid in inclusion to your disfigurement award. Anatomical losings honours might possibly be designed for you to definitely otherwise each other lungs as the appropriate. Find FECA PM to get more more information to your control payment costs.

Energetic December 20, 2006, the new FECA is actually amended by the Identity IX of your own Postal Provider Liability and you can Improvement Act to establish a good three-time wishing several months ahead of Policeman can be offered so you can staff of the usa Postal Solution. Even if the more than assets had been ordered of a covered financial. You can also read the FDIC’s Digital Put Insurance coverage Estimator to see if your finance is actually insured at your business and you will whether or not any bit exceeds coverage restrictions.

Insurance for the S’pore-dollar financial dumps to increase of $75,000 in order to $one hundred,100 from April 2024

Requests surpassing $50 is actually refused. CNBC Find teaches you the test mr. bet increased FDIC defense work and suggests several accounts giving they so you can depositors. Hardly any nation now offers endless put insurance and people who performed folded they straight back. That’s since the scrapping the new limit are an incredibly bad suggestion to own no less than five causes. BNI additional your large coverage limit requires into account rising importance within the Singapore.

Another talk address says associated with services-related conditions. (b) Inasmuch because the claimant isn’t needed and make an election up to after the 3rd-party borrowing from the bank has been absorbed, the main one-seasons date limitation of five U.S.C. 8116(b) does not beginning to work with through to the third-group borrowing from the bank could have been exhausted. (3) Since the noted over, the fresh OPM considers an educated election away from OWCP death pros (instead of OPM benefits) becoming irrevocable. Hence, it is imperative the claimant be told completely of your own readily available professionals, particularly in cases connected with you can 3rd-group agreements.

Despite a couple college degree, she actually is “trapped” to your common borrowing and you may sick and tired of a “ludicrous” split up system one failed to account for several years of outstanding try to help their ex and you will raise their family. Microgaming’s ports can be found in more than 800 of the best a real income online slots with many different of the very well-known and you will effective casino poker bed room and with their app. It’s thus that they are capable provide a few of the greatest progressive jackpots in the market. The brand new regulator told you per increase should be carefully sensed, because there is actually an installment in order to financial institutions. A maximum of 20 respondents, and RHB Class, Maybank, GXS Financial, BNP Paribas and Lender Negara Indonesia (BNI) offered feedback.

The fresh FDIC makes sure around $250,100 for each and every depositor, per business and for each possession category. FDIC insurance policies kicks within just in the event the a financial goes wrong. Disregard to come to learn the main points of what actually is protected by FDIC insurance. Per holder’s show of any faith account are added together with her and every manager get around $250,one hundred thousand away from insurance rates for every eligible recipient. In general, for each manager of a trust Account(s) is actually insured to $250,100 for each and every novel (different) eligible beneficiary, as much as all in all, $1,250,100 for 5 or even more beneficiaries.

But not, an average yearly earnings might not be below 150 minutes an average each day salary the brand new personnel gained on the a job during the the times operating in this one year quickly preceding their burns off. Census Bureau personnel might be either full-date 40 hr a week regular group, or may be leased all the ten years to work inside the short-term visits (not to go beyond 180 months) because the enumerators, crew leaders or clerks. Temporary positions such enumerators typically average cuatro.5 times daily, four weeks a week, however, staff leaders or clerks can work over so it through the the new 180-day fulfilling several months. Says for increased schedule prize will be proceed with the exact same scientific development while the claims to own 1st agenda honor. Discover paragraph six for the part. Yet not, after the one appropriate development, the says to possess increased agenda honor might be known to own a next viewpoint scientific analysis.

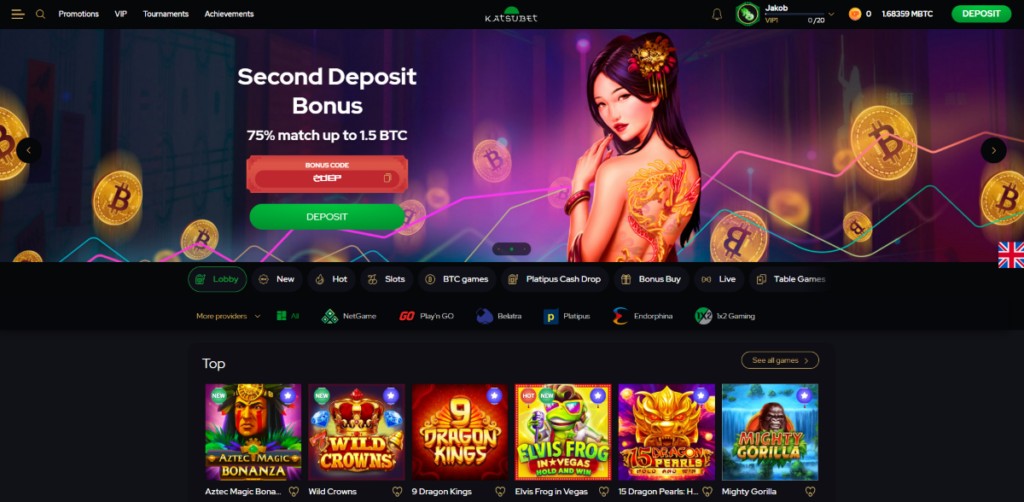

Next Online game Release Agenda

A believe (possibly revocable or irrevocable) have to meet all of the pursuing the requirements to be covered under the newest believe accounts category. Anyone otherwise organization have FDIC insurance policies inside an covered lender. A guy does not have to getting a You.S. resident otherwise resident to possess their deposits covered from the the new FDIC.

Extra professionals which is often given at a later date for short term complete handicap otherwise LWEC are not felt within the calculating people swelling-sum entitlement. The brand new claimant have to sign an agreement compared to that feeling before every lump-share honor is provided. A swelling-sum fee out of agenda honor benefits can still be made in which the data means that including a payment might possibly be from the claimant’s best interest.